Save for the beehive hairdo, shoulder-touching shirt collars and neon-colored jumpsuits, the vast majority of fashion fads eventually come back in style.

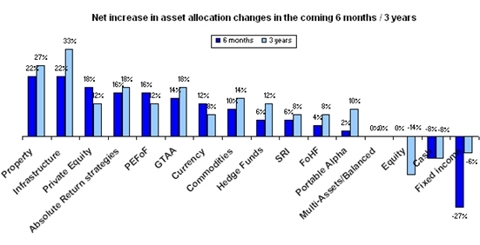

So is the case with alternatives, according to bfinance’s winter 2010 survey released late last month (click here to view the survey), which notes that property, infrastructure, private equity and “absolute return strategies” are not only back in favor but all the rage among pension funds. (Click chart to enlarge.)

It’s a post-2008 feather in the cap for these non-conventional investment strategies, which garnered the most positive sentiment among those surveyed – well over bonds, which are definitely out, and certainly over stocks, which in Frankie Valli-like fashion are still relevant but don’t seem to know when to call it quits (apparently his latest tour in the Miami area was not his best).

The survey found “highly positive attitudes” towards other alternative asset classes, including private equity, absolute return strategies, Global Tactical Asset Allocation and commodities. (Click here for AllAboutAlpha.com’s synopsis of last year’s survey, which focused on fee acrimony among other trends.)

What the results confirm, according to the report, is the broader trend that has been in place over the

Complete Story »

Lorri Bagley Leslie Bega Maria Sharapova Lindsay Price Zoe Saldana

No comments:

Post a Comment