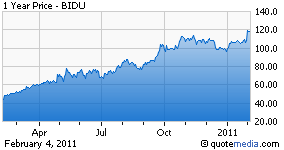

Baidu, Inc. (BIDU) has had - and continues to have - perhaps the best management of the global internet services companies. That’s quite a put down for the big guys in the U.S. Baidu is a clearly stabilizing and fast growing organization. The company has only been growing since 2006 and is making great headway. However, in my work it does not qualify as a “quality” firm – yet! Keep in mind that there are other, often smaller, internet firms that are more conservative, but few have produced any better investor ROI over recent years.

Earning estimates on balance are definitely positive for the near-term, and should continue improving for a long time. How the Street will reward or punish Baidu, or any other company in the future, is always questionable. It appears, according to comparative analytics, that the upside is becoming quite limited and that the downside currently has more appeal. With momentum and relative strength at current levels, shorting is out of the question, but hedging or taking profits may be a prudent strategy.

My analytics, to a large degree, have to do with comparative analytics. Comparing Baidu with its peers - and other top capitalization/revenue producing companies in general - provides a clear and very positive story of both the company and the internet services industry group.

Timely news includes the fact that higher projected earnings growth in the near-term have been much better than expected.

As a sector, the technology – internet arena and its component

Complete Story »

Padma Lakshmi Sarah Mutch Gabrielle Union Alessandra Ambrosio Amanda Detmer

No comments:

Post a Comment