Weekend Favs January Twenty Nine

This content from: Duct Tape Marketing

Ana Ivanovi Jessica Cauffiel Emmanuelle Vaugier Sarah Silverman Larissa Meek

Weekend Favs January Twenty Nine

This content from: Duct Tape Marketing

Ana Ivanovi Jessica Cauffiel Emmanuelle Vaugier Sarah Silverman Larissa Meek

Asia Argento Charisma Carpenter Hilarie Burton Kelly Carlson Sara Foster

Danneel Harris Veronika Vaeková Eve Brittany Lee Daisy Fuentes

By Maulik Mody

Consumer spending increased more than forecast in December, making the last quarter the best one of 2010. Spending increased 0.7% in the last month, following a 0.3% gain in November. Personal income grew for a third month in a row, continuing to grow at 0.4%. Although income and spending continues to grow, the pace is moderate making the recovery very slow. The Fed’s preferred gauge of inflation, the Personal Consumption Expenditure Core Price Index, was flat in December after advancing 0.1% in November.

However, data continues to show that manufacturing activity is gaining and is driving the recovery in the U.S., as seen in the Chicago Purchasing Manager index, which jumped two points in January to 68.8 from 66.8 in December. This is the highest level since 1988, as most components of the index came in stronger. New orders came in at 75.7, much stronger from 71.3, while employment strengthened to 64.11 from 58.4. These are reportedly the highest levels these components have reached since 1984. While production also picked up, inventories declined from 60.0 to 54.5.

The ISM-adjusted index increased to 65.6 from the high 65.0 in the previous month. The ISM manufacturing index is expected to level off a bit in January. The other regional manufacturing surveys have been mixed, with Kansas and Richmond declining, and Philly and New York increasing. The Chicago PMI index has remained the leader among the regionals, now nearly 10 points above the average of 56.1 for the four other

Veronica Kay Mýa Natalie Imbruglia Patricia Velásquez Jennifer Morrison

Our Greatest Referral Fear

This content from: Duct Tape Marketing

Brittany Daniel Kate Moss Zhang Ziyi Nikki Reed Natasha Bedingfield

Foxy Brown Ivana Bozilovic Cristina Dumitru Cat Power January Jones

Sara Spraker Alexis Bledel Kim Kardashian China Chow Alecia Elliott

Sarah Shahi Anna Paquin Diane Kruger Magdalena Wróbel Connie Nielsen

Rachael Leigh Cook Elisha Cuthbert Ciara Rachel Hunter Heidi Montag

The stock market hasn’t returned a single red cent in over twelve years, as measured by the S&P 500. Twelve years is a long time to go without earning a return on your investment, particularly if you are close to retirement.

With the boom years of the 1980s and 1990s now a distant memory, it is not shocking to see investors losing faith in the cult of capital gains and gravitating instead to dividend-paying stocks and ETFs.

Avril Lavigne Bridget Moynahan Noureen DeWulf Nicollette Sheridan Amber Heard

Big business used to have a monopoly on resources and tools that virtually kept customers hostage if they wanted a certain level or type of service.� This is no longer true, and Phil Simon?s The New Small: How a New Breed of Small Businesses Is Harnessing the Power of Emerging Technologies will show you exactly how small businesses just like yours are playing and earning big using tools and technologies that used to be out of reach forRead More

Big business used to have a monopoly on resources and tools that virtually kept customers hostage if they wanted a certain level or type of service.� This is no longer true, and Phil Simon?s The New Small: How a New Breed of Small Businesses Is Harnessing the Power of Emerging Technologies will show you exactly how small businesses just like yours are playing and earning big using tools and technologies that used to be out of reach forRead More

From Small Business Trends

The New Small Delivers Big Technology Insights for Small Business

Ashley Tisdale Rachel Blanchard Sienna Guillory Tricia Vessey Aki Ross

Amanda Bynes Ana Ivanovi Jessica Cauffiel Emmanuelle Vaugier Sarah Silverman

Jessica Paré Leelee Sobieski Teri Hatcher Lauren Bush Natalie Zea

Yvonne Strzechowski Rhona Mitra Kelly Rowland Danica Patrick Josie Maran

Cameron Richardson Chandra West Kasey Chambers Megan Ewing Kristanna Loken

5 Ways to Make Your Website Scream Local

This content from: Duct Tape Marketing

Robin Tunney Kate Groombridge Dania Ramirez Lucy Liu LeAnn Rimes

"Conditions in the mortgage market continued to produce substantial headwinds. During 2010, market interest rates were at historical lows and pushed mortgage rates below 5%. This caused prepayments and refinancing activity to increase, resulting in lower yields on our mortgage related assets. As expected, the continued low interest rate environment continued to negatively impact our net interest margin in the fourth quarter. The recent increase in longer-term market interest rates have pushed mortgage rates higher, but the continued elevated levels of employment, the weak housing market and the unprecedented level of US government-sponsored enterprises (the "GSEs") involvement in the mortgage market have impacted our ability to grow our loan portfolio as the GSEs were involved in over 90% of U.S. mortgage production."

"As we look forward to market conditions that are more conducive to our business model, we're exploring the best ways to reduce interest rate risk, strengthen our balance sheet to restore traditional earnings trends and to prepare our balance sheet for future growth. We expect that this process would result in a further restructuring of our funding mix-a process we started in 2009 with the modification of putable borrowings to extend or eliminate put dates and to fund asset growth with consumer deposits. Any such restructuring will focus on the prospects for long-term overall earnings stability and growth as market and economic conditions become normalized. We believe it is important to adjust to current market conditions and prepare to capture a greater share of the residential mortgage market when conditions improve. While it is difficult to predict when that may occur, we believe that this is the time to look ahead to the 'new normal.'"

Halle Berry Catherine Bell Tessie Santiago Jessica Simpson Mandy Moore

Are you planning to hire new staff in 2011? After two years of slashing staffs to the bone, many small businesses may feel it?s finally time to staff up so they can take advantage of the recovery.

But do you know where to find those workers?

The world of hiring has changed, and the Wall Street Journal recently took a look at how companies are planning to hire in the coming months. Here?s some ofRead More

From Small Business Trends

Do You Need to Hire This Year? Where Will You Find New Employees?

Cindy Taylor Halle Berry Catherine Bell Tessie Santiago Jessica Simpson

Let?s talk about 2011 marketing trends. You may be saying to yourself,

?The year has just begun–how can there be a trend already??

In November 2010, Ad-ology Research surveyed 752 small businesses owners in order to study ?their attitude toward advertising.?� This annual study gives a snapshot of small business owners? marketing plans and reveals their expected advertising expenditures for this year.� The 2011 Small Business Marketing Forecast included U.S. businesses with fewer than 100 employees (82 percent of thoseRead More

From Small Business Trends

2011 Small Business Marketing Forecast

Laura Prepon Ashley Scott Michelle Behennah Julie Benz Saira Mohan

2011 (projected) | |||

GDP Growth | Government | Government | |

Group, Country | Rate (%) | Deficit (% GDP) | Debt (% GDP) |

Advanced Economies | 2.5 | 7.1 | 101.0 |

US | 3.0 | 10.8 | 97.9 |

Euro Area | 1.5 | 4.6 | 87.1 |

Japan | 1.6 | 9.1 | 227.5 |

Emerging Economies | 6.5 | 3.2 | 36.8 |

China | 9.6 | 2.1 | 18.1 |

India | 8.4 | 9.2 | 75.2 |

Brazil | 4.5 | 3.1 | 67.5 |

South Africa | 3.4 | 5.3 | 39.5 |

Private Investors | 2007 | 2008 | 2009 | 2010 (3 qtrs.) |

US Investors | -367 | 198 | -208 | -206 |

Foreign Investors | 672 | -5 | 23 | 379 |

US Govt. Debt | 67 | 161 | 23 | 269 |

Private Securities | 605 | -166 | 0 | 109 |

Net | 306 | 193 | -185 | 173 |

Elliott: Tell me about the real estate cycle.Brad: The commercial real estate market cycle is long, about 18 years; the last one was 17 1/2 years, give or take one quarter depending on which measure you use. REITs typically move through downturns quickly, but the last one was extraordinarily severe and lasted 25 months. That still leaves roughly 16 years of upturn, and we're now less than two years into it.Elliott: How about real estate investments?Brad: Although REITs have gained 189% from their market bottom on March 6, 2009, they're still down 22% from their pre-downturn peak on February 7, 2007. Real estate operating fundamentals (occupancy rates, rent growth, etc.) are at or just past their worst point. That means that earnings growth seems likely to be strong over the next several years as operating fundamentals improve.

Performance (annualized) | Price/ | Dividend | ||

Investment Vehicle | 1-Year | 3-Year | Earnings | Yield (%) |

Korea (EWY) | 23 | -5 | 10 | 0.7 |

Latin America ((PRLAX)) | 14 | 2 | 11 | 0.7 |

Brazil (EWZ) | 1 | 1 | 12 | 3.5 |

South Africa (EZA) | 22 | 2 | 13 | 2.0 |

India ((MINDX)) | 32 | 2 | 16 | 0.5 |

China ((MCHFX)) | 21 | 1 | 16 | 0.2 |

Performance (annualized) | Price/ | Dividend | ||

Investment Vehicle | 1-Year | 3-Year | Earnings | Yield (%) |

Brookfield Asset Management (BAM) | 57 | 2 | 11 | 1.6 |

Fidelity Real Estate Income ((FRIFX)) | 20 | 5 | 18 | 5.1 |

REMS Real Estate Value ((HLPPX)) | 34 | 5 | 39 | n.a. |

Vanguard REIT ((VGSIX)) | 31 | -2 | 42 | 3.1 |

Cohen & Steers Realty ((CSRSX)) | 30 | 0 | 44 | 2.2 |

Performance | Price/ | Dividend | ||

Investment Vehicle | 1-Year | 3-Year | Earnings | Yield (%) |

Vice ((VICEX)) | 14 | -10 | 15 | 1.1 |

[1] Burton G. Malkiel, “A Random Walk Down Main Street”: W.W. Norton.

Jordana Brewster Laetitia Casta Claudette Ortiz Julia Stiles Marisa Miller

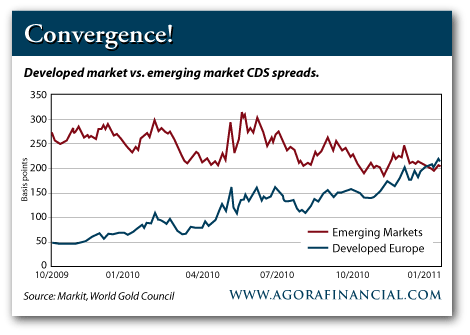

The European Union, along with the U.S., is supposed to represent the heart of the developed world. Europe is now an emerging economy, as shown by the following graph from the 5 Min. Forecast:

Europe is now an emerging market and trend lines would project it is riskier than the rest of the emerging market world.

China Chow Alecia Elliott Kat Von D Ana Paula Lemes Vanessa Simmons

With gold prices showing no signs of a breakout in 2011, so far, many investors have started unwinding long positions in anticipation of no further upside. The situation warrants a close scrutiny of the state of affairs. In the following part of this essay we analyze indications from the correlation matrix and technical indicators from silver and mining stocks to gauge the extent of this concern.

However, first, we would like to draw your attention to the fact that the London Bullion Market Association conducted its annual survey of leading analysts to ask them where the price for gold will go in 2011. A total of 24 contributors gave their estimates for the high, low and average price for 2011 for gold, silver, platinum and palladium. In 2011, forecast contributors predict rises for all precious metals. Their average gold forecast is U.S. $1,457, a 19.0% increase on the 2010 average price, similar to the forecast of $1,450 made by delegates at the 2010 LBMA Precious Metals Conference in Berlin last September. Analysts predict that the average silver price will be $29.88, a 48% rise on the 2010 average price. The average 2011 platinum price is forecast to rise 12.6% from the average 2010 price, to $1,813 and palladium shows no sign of slowing down with an average 2011 price prediction of $814.65, a 54.8% increase on last year’s bumper average price.

Kim Kardashian China Chow Alecia Elliott Kat Von D Ana Paula Lemes

This is a guest post by Brendan Cruickshank. Pick up any newspaper or magazine today and start reading about the economy. What you will see is not pretty. Reports are grim and it's easy to see why; the nation has been looking at unemployment... Read more

Amanda Peet Xenia Seeberg The Avatars of Second Life Daniella Alonso Gina Gershon

How the BLS is deflating its inflation statistics. The new centrism and its discontents. For some reason, I've never run across Trend Hunter. Until now. It's good. Is professionalism dead? (via Economics Roundtable) Self-control in... Read more

LeAnn Rimes Adrianne Curry Jennifer Gimenez Katie Cassidy Estella Warren

The Dow Jones Industrial Average, also known as DJIA or DJ-30, has recently broken past the 12,000 mark. With that in mind, I thought it would be a good time to take a closer look at the Dow, to see where we are at and where we might be headed.

Fundamentally, I see two primary factors worth paying attention to:

Brooke Burns Lena Headey Ali Larter Angelina Jolie Erica Leerhsen

Mia Kirshner Elisabeth Röhm Lily Allen Emmanuelle Chriqui Anna Faris

By Conley Turner

Volatile was the primary adjective to describe oil prices in the past several days. After approaching the $92 per barrel level in the previous week, the commodity made a sharp reversal to the downside in subsequent trading sessions. Crude oil gave up over 2 percent of gains in short order as result of an array of disparate factors. Geopolitics eventually proved to be the primary reason for the recovery of much of those losses.

Leonor Varela Joanne Montanez Michelle Obama Kerry Suseck FSU Cowgirls

Avril Lavigne Bridget Moynahan Noureen DeWulf Nicollette Sheridan Amber Heard

Samantha Mumba Busy Philipps Thora Birch Jennifer Garner Poppy Montgomery

Janet Jackson Georgianna Robertson Reese Witherspoon Jordana Brewster Laetitia Casta

This is a follow up to a list we generated a few days ago (Top 15 Most Undervalued BRIC Stocks by Analyst Target Price). In that article we identified 15 stocks from Brazil, Russia, India and China that trade at steep discounts relative to analyst target price (used as a proxy for fair value).

We know that this is a naive way of finding undervalued companies, so we decided to dig deeper. We crunched numbers on several valuation ratios, and compared the original list to industry averages.

Molly Sims Monika Kramlik Lacey Chabert Amber Brkich Gretha Cavazzoni

Shana Hiatt Tara Conner Drea de Matteo Trista Rehn Moon Bloodgood

Gina Gershon Ehrinn Cummings Sienna Miller Cindy Taylor Halle Berry

Autumn Reeser Camilla Belle Blu Cantrell Jaime King Lokelani McMichael

Charlize Theron Eva Mendes Sarah Polley Aisha Tyler K. D. Aubert

Como en cada edici�n, este mes MSDN Flash ha publicado una entrevista a un profesional destacado: Carlos Guevara. Carlos cuenta con m�s de 14 a�os dedicados a la programaci�n Web, desarrollando para importantes empresas de la regi�n, y es adem�s un activo expositor en eventos Microsoft. Con cada vez m�s compa��as trabajando en la nube, compartimos en este espacio sus puntos de vista:

Como en cada edici�n, este mes MSDN Flash ha publicado una entrevista a un profesional destacado: Carlos Guevara. Carlos cuenta con m�s de 14 a�os dedicados a la programaci�n Web, desarrollando para importantes empresas de la regi�n, y es adem�s un activo expositor en eventos Microsoft. Con cada vez m�s compa��as trabajando en la nube, compartimos en este espacio sus puntos de vista:

Carlos Guevara: Como todo, a nivel de tecnolog�a en el mundo de hoy, los requerimientos y prestaciones que uno espera de una plataforma computacional dependen mucho de las caracter�sticas de la soluci�n a desarrollar, as� que posiblemente no exista una respuesta totalmente correcta o que aplique a todas las necesidades de los departamentos de IT de nuestra regi�n. Aun as�, hay m�ltiples consideraciones que deber�an tomarse en cuenta siempre, y yo normalmente las agrupo en cuatro categor�as diferentes que ser�an las Caracter�sticas de la plataforma en la nube, Los Niveles de Servicio y Respuesta que se ofrecen, la localizaci�n de los recursos y el Costo Beneficio de los mismos.

Posiblemente la m�s cambiante de estas categor�as es la de Caracter�sticas, por lo r�pido que se mueve la tecnolog�a en estos momentos, y por lo variado de las necesidades de los diferentes clientes. En mi experiencia algunas de estas caracter�sticas que son de suma importancia incluyen: la facilidad de desarrollar para esa plataforma, la facilidad de administraci�n y delegaci�n de los aspectos de configuraci�n de la misma, la capacidad de integraci�n a los componentes de mi infraestructura y aplicaciones de legado ? como lo son mecanismos de autenticaci�n y seguridad, y la integraci�n y exposici�n de servicios desde y hacia aplicaciones existentes internas y externas entre otras cosas.

Obviamente cuando se contratan servicios de computaci�n en la nube, uno de los principales beneficios es la garant�a de escalabilidad y disponibilidad de nuestras aplicaciones hospedadas all�, por lo que el SLA o Acuerdo de Niveles de Servicio/Respuesta, es un factor de extrema importancia. Estos acuerdos deben verse minuciosamente y deben tomarse muy en cuenta a la hora de escoger un proveedor.

Otro tema que muchas personas no toman en consideraci�n, es el lugar final donde van a residir las aplicaciones. El proveedor de servicios debe identificar sus centros de operaciones, ya que muchas veces por temas legales, o temas de accesibilidad de la informaci�n, el cliente debe poder tener opciones para escoger d�nde deben residir sus datos o aplicaciones y en cuantos lugares deben poder replicarse los mismo.

Por �ltimo, el costo siempre es un factor determinante. Especialmente cuando consideramos que uno de los m�s grandes beneficios de la computaci�n en la nube es el de poder controlar de la forma m�s granular el costo de nuestras operaciones. Mientras m�s granular sea el manejo del costo, y m�s f�cil y r�pido sea el cambiar la configuraci�n de nuestro esquema en cuanto a instancias, tama�o de las mismas y dem�s, mejor ser� el costo beneficio de la misma.

CG: Este tema en realidad pareciera muy subjetivo, pero en realidad depende mucho del motivo por el cual una empresa espec�fica escoge utilizar la nube para manejar sus operaciones tecnol�gicas. Normalmente yo explico la diferencia entre IAAS y PAAS como la diferencia entre un programador de C++ y uno de .NET. El programador de C++ escoge ese lenguaje porque quiere acceso directo a la infraestructura, porque no quiere que se instalen componentes o librer�as que no le sirvan a �l y prefiere ese nivel de control para garantizar que su aplicaci�n rinde al m�ximo para su requerimiento, aunque sabe que va a tener que trabajar mucho m�s para lograr su cometido. El programador de .NET est� consciente que utiliza controles y objetos pre-hechos, que est�n orientados a dar el mejor beneficio para la mayor�a de los usuarios, pero no necesariamente optimizados a su soluci�n misma, pero esto no afecta en gran manera sus necesidades.

IAAS es un esquema de computaci�n en la nube que para algunos departamentos de IT parecer� m�s natural. Mantendr�n absoluto control de lo que se instale en sus servidores y de su manejo. Pero este nivel de control implica que no se puede reducir en gran manera la carga a su departamento de IT. El principal objetivo es reducir la cantidad de compras y facilitar los mecanismos de procuradur�a para poder crecer m�s r�pidamente, pero cada uno de estos ?crecimientos? va a implicar un alto nivel de trabajo, pruebas, etc.

Los usuarios que escojan PAAS cuentan con una soluci�n que elimina grandemente los dolores de cabeza de crecimiento. La aplicaci�n puede crecer sin gran esfuerzo por parte del departamento de infraestructura de tecnolog�a de la empresa. La escalabilidad es m�s r�pida, m�s fluida y m�s confiable.

Normalmente yo recomiendo IAAS solo para empresas que necesitan un alto nivel de control, como empresas de desarrollo de software, especialmente las que trabajan en construir aplicaciones tipo SAAS (Software as a Service) y que necesitan mucho control sobre funcionamientos espec�ficos de la infraestructura. Tambi�n se recomienda para empresas que tengan requerimientos de legado muy espec�ficos, que no est�n provistos en las soluciones PAAS normales, pero en ambos casos, es mi experiencia que son muy pocas empresas las que requieren tomar esta decisi�n.

CG: Existen numerosas herramientas, y en mucho dependen de tu plataforma de desarrollo favorita y el esquema de arquitectura en la nube o proveedor seleccionado. Existe una soluci�n open source llamada Cloud Tools que es muy recomendada especialmente para ciertos tipos de aplicaciones en JAVA y que funciona muy bien con Amazon Elastic Compute Cloud (Amazon EC2), y Google tiene un SDK muy poderoso, aunque un poquito complejo para su soluci�n de computaci�n en la nube.

Claro que yo estoy mucho m�s parcializado a las soluciones de Microsoft, pues Visual Studio 2008 y 2010 tienen excelentes caracter�sticas para desarrollar soluciones a la nube y en particular hacia Windows Azure. Estas hacen que la programaci�n sea mucho m�s din�mica y f�cil de implementar.

Y para los que quieren empezar a programar hacia AZURE, Microsoft tiene una soluci�n llamada WebMatrix que mediante plantillas y wizards o asistentes, ayuda a crear diferentes tipos de proyectos que se pueden hospedar ya sea localmente o en Windows Azure. En realidad los ejemplos documentaci�n y soluciones que provee WebMatrix son sumamente �tiles, pr�cticos y educativos para los que est�n aprendiendo o los que quieren soluciones r�pidamente.

CG: Al ponderar esta pregunta, inmediatamente vino a mi mente lo mucho que ha avanzado la tecnolog�a de computaci�n en la nube en los �ltimos tres a�os. En ese momento hubiera podido contestar con numerosos ejemplos por la falta de integraci�n de mecanismos de autenticaci�n como Active Directory, o integraci�n con modelos de arquitecturas distribuidas, que se hac�an imposibles de manejar en la nube.

Pero las empresas y en particular Microsoft han avanzado mucho, muy r�pidamente. El hecho que Microsoft haya dedicado los �ltimos dos PDCs (Professional Developer Conference) a mejoras en Windows Azure como AppFabric, han avanzado tanto la capacidad de su plataforma que no puedo considerar una soluci�n que no sea posible hacer en la nube.

El �nico factor determinante ser�an aplicaciones de legado muy antiguas que no pudieran conectarse a sistemas en la nube.

CG: Uno de los puntos m�s interesantes para m� acerca de Azure es su CDN (Content Delivery Network), lo cual permite que aunque mi aplicaci�n est� hospedada en la regi�n Noreste de Estados Unidos, por ejemplo, existan mecanismos para hacer CACHE DIN�MICO de datos e informaci�n de mi aplicaci�n en m�ltiples lugares alrededor del mundo, para garantizar disponibilidad y tiempo de respuesta de la aplicaci�n hospedada.

Adicionalmente, AppFabric es una de las caracter�sticas que como desarrollador m�s me orientan a escoger las soluciones de Windows Azure, pues es el ?MiddleWare? ideal para facilitar la interconexi�n de aplicativos, servicios e infraestructura como Active Directory (ADFS) a nuestras aplicaciones. AppFabric reduce la complejidad de aplicativos interconectados como nada que yo haya visto anteriormente.

Por �ltimo, la interoperabilidad de AZURE hacia productos y plataformas de m�ltiples proveedores brinda un gran valor y beneficio al desarrollador. Poder contar con optimizaciones no solo para Visual Studio y las plataformas .NET, sino tambi�n para aplicaciones en JAVA y PHP entre otras, y que todas convivan como aplicaciones nativas y de primer mundo en la plataforma es incre�blemente valioso, y m�s cuando no es necesario una gran cantidad de esfuerzo para que estos componentes se hablen entre s�.

Tatiana Zavialova Tila Tequila Tamie Sheffield Kelly Monaco Gisele Bündchen

Coming into the New Year, we saw lots of reports that small business owners would be upping their social media spend in 2011. Reports suggested perhaps the “experimentation” days of social media were over and that businesses were beginning to treat it like a real marketing channel, with dedicated resources. To give us some insight into how small businesses are using the medium and where they?re finding success, eMarketer recently highlighted an Adology survey of 752 SMBsRead More

From Small Business Trends

Which Social Media Sites Are Most Beneficial?

Rachel Blanchard Sienna Guillory Tricia Vessey Aki Ross Ashley Tappin

Commodity markets are trading mixed Thursday, pushed and pulled each way following Japan's S&P downgrade, the U.S. Fed's confirmation it will be continuing the $600 billion bond purchase program, and the Congressional Budget Office (CBO) announcement that the U.S. will see its largest budget deficit on record at around $1.5 trillion.

The crude oil market sees additional newsflow pushing prices, with the WTI and Brent spread widening once again to over $10/bbl following the weekly Department Of Energy (DoE) oil inventory stats released by the Energy Information Administration (EIA) yesterday. Key to the move was yet another increase in stocks at Cushing, Oklahoma, which is the key delivery hub for Nymex West Texas Intermediate, and as such, offers an insight into near-term delivery potential and supply levels for the U.S. benchmark.

Rosario Dawson Tricia Helfer Elena Lyons Brooke Burns Lena Headey

Kate Groombridge Dania Ramirez Lucy Liu LeAnn Rimes Adrianne Curry

Jennifer Love Hewitt Tina Fey Gina Philips Jamie Gunns Ananda Lewis

Brittany Daniel Kate Moss Zhang Ziyi Nikki Reed Natasha Bedingfield

J.P. Morgan reiterated its Overweight rating on Tesla Motors (TSLA), giving the shares a bit of a boost. They have a one year price target of $30 (about 30% upside) and a three year target in the $40 – $50 range. They believe the majority of the investment community is underestimating the potential of the company with its power-train (used by Daimler (DDAIF.PK) and Toyota (TM)) and non power-train technologies.

The argument out of JP Morgan is certainly a valid one, particularly with Toyota and Daimler on board with the technology, but I still feel that there are better longer term investments out there. For example Nissan (NSANY) which is launching the LEAF is up 50% since July and Toyota Motors (TM) is up 20% in three months. Tesla is down nearly 40% in two months and about flat since the summer highs.

Kat Von D Ana Paula Lemes Vanessa Simmons Chyler Leigh Julie Berry

Si quieres comenzar tu aprendizaje de C#, o quieres profundizar tus conocimientos en aspectos m�s avanzados, te compartimos hoy un par de recursos de gran valor. Ambos son del sitio Faculty Connection de Microsoft.

Para principiantes en C#, la p�gina Suggested Resources for Introduction to Programming with C# (Recursos sugeridos de introducci�n a la Programaci�n con C#) es un excelente punto de comienzo. Sea que conoces otro lenguaje, como Java, o que reci�n comienzas tu aprendizaje de programaci�n. Incluye hasta materiales de referencia (como libros que puedes buscar en la biblioteca de tu instituci�n educativa), hasta v�nculos a sitios como DreamSpark para que descargues todo el software que necesitas.

En cambio, si ya conoces C#, puedes aprender temas m�s avanzados, aprovechando las descargas del sitio llenas de recursos.

Aseg�rate de visitar el sitio en espa�ol para que aproveches todos los recursos para estudiantes y profesores.

Vanessa Simmons Chyler Leigh Julie Berry Lori Heuring Nicole Scherzinger

Tila Tequila Tamie Sheffield Kelly Monaco Gisele Bündchen Jennifer Aniston

The goal of this article is to find superior stocks by analyzing companies outperforming their industry in a few key areas.

In theory, these superior fundamental stocks should be great price performers when tracked over a long period of time. In practice, we need to be careful that while focusing on a few key fundamentals we do not overlook the big picture. There were free drinks and great music being played while the Titanic sank.

Vanessa Marcil Rachel McAdams Kristin Cavallari Brittany Murphy Britney Spears

Salma Hayek Jennifer Scholle Tatiana Zavialova Tila Tequila Tamie Sheffield

Audrina Patridge Simone Mütherthies Carrie Underwood Rosario Dawson Tricia Helfer

Kristin Cavallari Brittany Murphy Britney Spears Amanda Swisten Scarlett Chorvat

Lacey Chabert Amber Brkich Gretha Cavazzoni Marla Sokoloff Jennifer Love Hewitt

The U.S. Treasury has announced its plan to auction 465.1 million of the Citigroup Inc.’s (C) warrants it holds. The warrants were received as part of the bailout provided to the troubled bank during the financial crisis.

The warrant holders have the option to buy Citi common stock at a fixed price within a specified time period. Lenders also have the right to place bids to buy back the warrants.

Rozonda Thomas Rachel Weisz Miranda Kerr Sarah Shahi Anna Paquin

When I began focusing on value investing I started out using a Discounted Cash Flow method to determine the future value of a security. However, the problem with DCF is that it forces you to predict and if you have a long time horizon (say ten years), only a fractional difference in growth rates or risk free rates can move valuations at light year distances.

Consider, for example, a cash flow stream that you would like to discount over ten years with 10 year treasury bonds (3.72% in this example) as a risk free return. Let's assume that the investment is returning $1 in the first year, with an (gu)estimated growth rate of 4%. With these assumptions, the net present value of the investment is $13.17. Now, suppose that the growth rate is 5%. The net present value changes with this increase of one percent to $52.02, an astronomical difference. After tinkering with this method for some time, I came to the conclusion that this forced predicting was leading me astray from finding value. I needed an alternative aproach.

Kerry Suseck FSU Cowgirls Abbie Cornish Krista Allen Hayden Panettiere

Do you use Google Gmail and are you looking for an easy way to keep on top of your business contacts? Consider Rapportive.

Most CRM platforms demand that you be in their dashboard or application to see details about a customer.� That means one more app to keep open on your desktop.� Rapportive aims to do away with that, at least for Gmail users, by providing you with social data in the right-hand column of your inbox.

You can seeRead More

From Small Business Trends

Social Customer Relationship Management with Rapportive

Alice Dodd Kate Walsh Autumn Reeser Camilla Belle Blu Cantrell

Marisa Tomei Shannyn Sossamon Rachael Leigh Cook Elisha Cuthbert Ciara