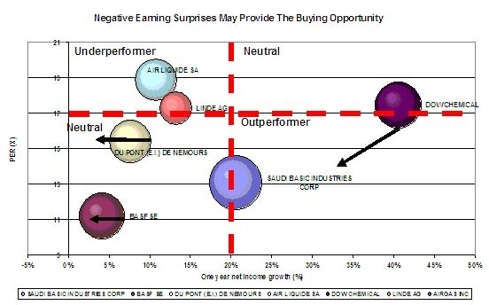

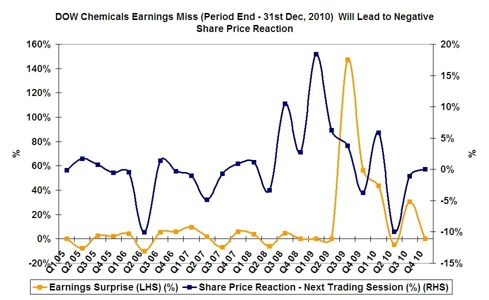

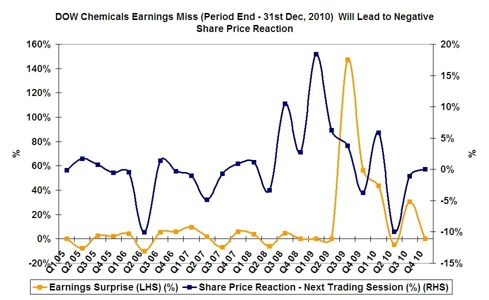

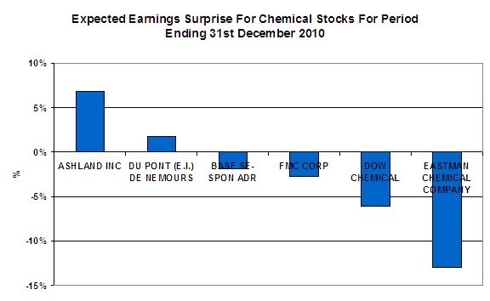

Dow Chemicals (DOW), DuPont (DD), Eastman Chemical (EMN), FMC and BASF (BASFY.PK) had a great run in November and December 2010 on the back of a third quarter earnings beat (period ending 30th September 2010 (Q3 / Q4)). Most of these chemical manufacturers also presented a rosy forward outlook. This was followed by earnings revisions and upgrades by the analysts raising Q4 2010 (period ending 31st December 2010). A key test of these estimates will come in the upcoming weeks as most of the chemical companies are reporting their Q4 2010 / Q1 2011 earnings. On the basis of industry fundamentals (basic chemicals, intermediate, specialty and agriculture) in different markets (North America / EU, Latin America & Asia Pac) and company fundamentals, we are of the view that only Ashland Chemicals (ASH) can beat the street’s estimates in a convincing way, whereas both DOW Chemicals and Eastman Chemicals may post a negative earnings surprise, which may result in a negative share price reaction for these companies. This should present investors a buying opportunity for the chemical manufacturers with higher contribution from specialty, performance and agricultural chemical manufacturers with higher exposure to US / EU (DOW Chemicals, BASF and Eastland Chemicals), as this will lower the street’s expectations for 2011 and set these names up for an upside earnings surprise and positive price performance in 2011.

Click to enlarge images

Chemicals Market in the Period Ending 31st December 2010 and 2011 Outlook

- Chemical Prices: The prices of chemicals have recovered from bottom in Q1 2009, but stability and further price improvement is dependent on sustainable economic recovery. Saudi Basic Industries & DOW Chemicals has an upside even in the case of depressed prices (bearish economic scenario), as it may necessitate further infrastructure-driven stimulus packages which may be supportive of chemicals demand and prices.

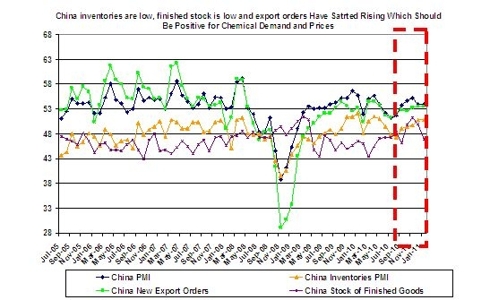

- Inventories / Order Backlog: Inventory build up in auto, specialty plastics and performance chemicals, as inventory to sales ratio increased to a higher level by the end of Q3 2010, affecting the sales in specialty chemicals in US / EU. Higher new export orders, lower finished good inventories and raw material inventories in China are positive for commodity chemicals and sales in China and Asian Pacific for H1 2011.

- Agricultural Inflation and Agricultural Chemicals: Agriculture chemicals prices and usage were higher in all geographical regions in Q3 / Q4 2010. Drought in Russia and Argentina and floods in Brazil, Australia and Pakistan will keep the grain prices higher in Q1 2011 and H1 2011 – which should be beneficial to the producers of agricultural chemicals.

- Specialty Chemicals: Specialty chemicals sequential sales volume was down in the quarter (Q42010) but higher compared to the same period 2009. Commodity chemicals sales were sequentially flat in China & Asia Pacific and slightly down in North America. We expect the specialty chemical prices to be stronger in 2011.

- Feedstock Cost & Margins: The margins of most of the chemical producers should have been negatively affected by the rise in the price of naphtha and rise in coal prices because of floods in Australia. It is expected that the chemical producers will face a sequential drop of from 300 bps (SABIC) to around 500 bps (FMC). The feedstock cost advantage for SABIC is getting diluted as additional capacity comes on line in places like Europe & China. Mixed feedstock cash cost is much higher than the SABIC KSA feedstock cash cost. Also, there had been a recurring concern about cheap feedstock running out, thus removing the relative cost advantage.

- Higher Expectations: Analysts raised earnings expectations for likes of DOW Chemicals, BASF, El Dupont De Nemour and Eastman Chemicals after most of the chemical manufacturers reported an earning’s surprise in Q3 2010. Better than expected performance by the specialty chemicals segment compared to commodity chemicals and better than expected sales in North America and Euro area compared to the sales in emerging markets contributed to positive Q3 2010 earnings surprises. A negative earning surprise in Q1 2011 will result in lowering the market's expectation, setting the stage for an out-performance.

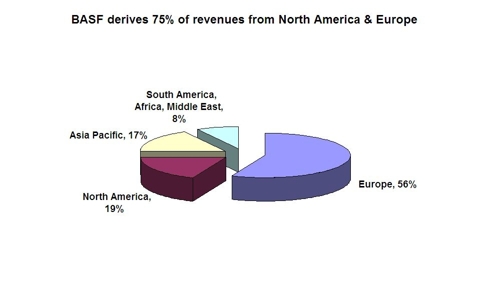

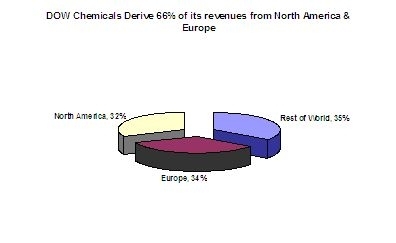

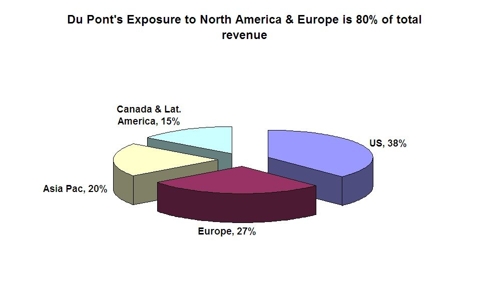

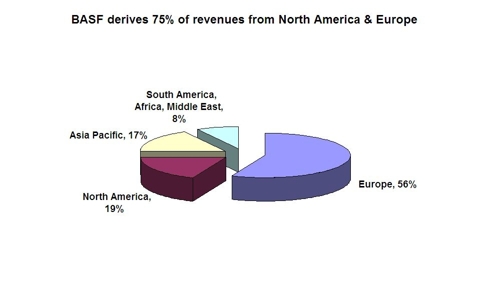

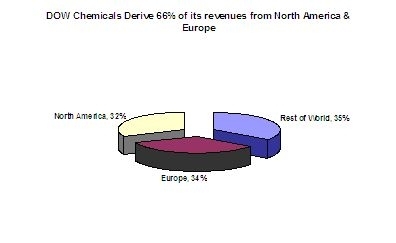

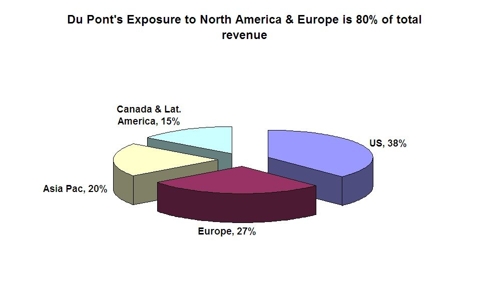

- China & Emerging Markets: Sales of specialty chemicals had been weaker than commodity chemicals in terms of volumes & pricing. The companies with higher revenue exposure towards US & EU markets are likely to post a negative earning surprise (DOW, BASF, and DuPont). Companies with higher exposure to emerging markets may be better off in revenues as well as prices for Q4 2010.

- Protectionism in Petrochemical industry: There has been a recent spat of news on emerging protectionism in petrochemical industries (in India & China). However SABIC management has downplayed the litigation, outcome and any possible impact on SABIC P&L. Indian Reliance case has been appealed with WTO and SABIC management expects a positive outcome.

- Chemical Cycle and Interest Rate Cycle: Many industry analysts are calling for a peak in chemical cycle in 2011 because of growth and interest rate sensitivity of product prices and sold volumes. We expect a modest growth in commodity chemical prices and volumes and a much higher growth in specialty and agricultural chemicals in 2011.

- Capacity Growth: BASF, Dupont & SABIC are estimated to be at the forefront of capacity growth in 2011. SABIC have total chemical capacity of around 60 million tons per annum at the end of 2010 (55 million tons in 2009). Expansion operations and investments are projected to amount to USD80 billion until 2020 and will increase overall annual production from 43 million metric tons in 2004 to more than 80 million metric tons by end 2011.

Chemical Stocks Outlook:

BASF, BAYER AG & DOW Chemical Company all surprised the street to the upside. Reported surprise was in line with SABIC’s third quarter earnings surprise and for the same reasons (refer to October 19th article, “Dow may surprise the market on upside”).

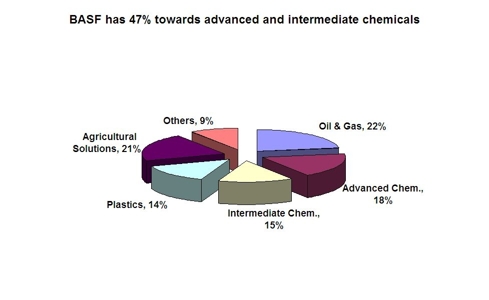

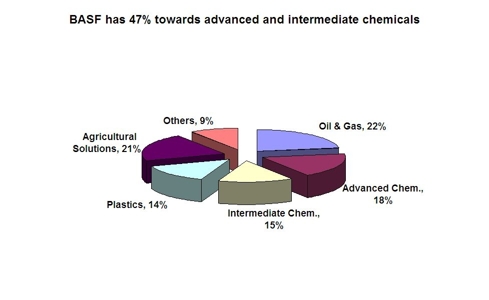

BASF PK: BASF, the world's biggest chemicals company, posted partial third-quarter results surprising the market on the upside. BASF also raised its full-year guidance. BASF raised its profit goal for 2010 after recovering markets helped lift third-quarter profit beyond analysts’ estimates. The German company in its outlook in October 2010 foresaw a “good business development” in the fourth quarter, with full-year earnings before interest, tax and special items exceeding 8 billion euros ($11 billion). Revenue is expected to reach 63 billion euros. If BASF meets its new guidance, the results would exceed previous records for sales and operating profit. However, less than expected demand growth in specialty, coatings and infrastructure segments and decline in gross margins may result in a negative earnings surprise in the period ending December 31st 2010.

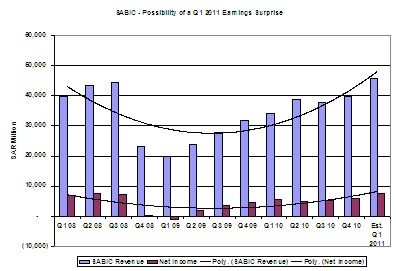

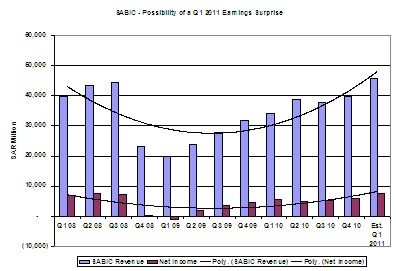

Saudi Basic Industries Corporation: SABIC reported Q4 2010 earnings last week. The earnings were above Reuter’s consensus of SAR5.3 billion, Bloomberg consensus of SAR6 billion and our in house estimates of SAR5.67 billion. However the investors may feel slightly disappointed, as expectations had been raised by YANSAB (51% owned by SABIC) and SAFCO (43% owned by SABIC) beating the markets expectations. The prices of most of the products sold by SABIC increased by +15% sequentially and the market was estimating an increase in sold volumes as CU rate should have increased. This was not reflected in the top line growth of only 5%. It implies that either sequential volumes and hence utilization rates were down or prices not reset to the benchmark prices in this quarter. We think that it is the price reset frequency which may have resulted in smaller than expected increase in the top line. Increase may have only come from the volumes increase because of increase in capacity utilization rates. Increase in price of Naphtha in the quarter (Q3/ Q42010) is also visible as we did not see a leverage impact at gross margin level – an increase in margins on the fixed cost side of business being absorbed by a decline in the margins on the variable cost side of the business. The net margins expanded by 100 bps (15%) because of YANSAB beating the estimated and higher associate income from SAFCO. We expect the utilization rate to be higher in Q1 2011 as inventories in Auto plastics are running thin. Product prices may be readjusted upwards in Q1 2011 as maximum lag is around 3-4 months. This may result in around 15% sequential increase in top line in 2011 which may result in a 27% increase in the bottom line, assuming a further 7% sequential increase in the cost of feed stock. However, leverage impact of the fixed cost side of business may dominate an assumed 7% increase in the variable side of the business resulting in a sequential improvement in the gross margins but a 100 bps yoy decline in the gross margins. We expect a good H1 2011 from the fertilizer business and overall earnings in H1 2011 can touch SAR14.74billion and SAR26-28 billion for the FY2011.

DOW Chemicals: Consensus expects the Dow Chemical Company to report the sales of $12.9 billion in Q4 2010 (23 percent yoy) (Bloomberg consensus). Top-line growth is expected to be driven by a 14% increase in volume and a 9% increase in price. Product prices have increased 15% sequentially, but the full impact of a benchmark prices increase may not be felt in the revenues because of contract reset frequency which on average lags the benchmark prices from three to six months. Based on historical price reset relationship, it may be fair to estimate only a 10% increase in the product prices and a sequential decline in the volumes – which may be more than consensus estimates. The volumes sold will be below consensus estimates in North America (17 percent), Latin America (9 percent) and 3% in Asia Pac which may cause a negative earnings surprise in Q4 2010.

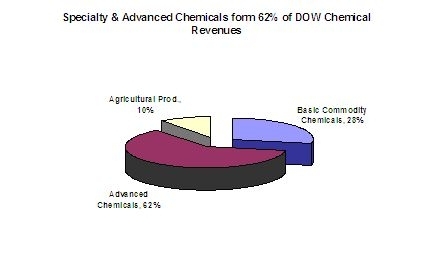

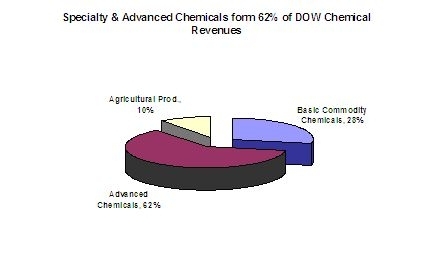

The consensus estimates will be helped by strong pricing and volumes growth in agricultural & health segments but may be affected negatively by a drop in sold volumes in specialty chemicals and performance materials which constitutes 65% of total revenues.

Because of the drop in volumes sold in 52% of the revenue segment, Dow’s global rate may drop to around 82% in Q4 2010, 400 bps below last quarter’s 86%. Further, it is estimated that gross margins may decline by around 500 bps.

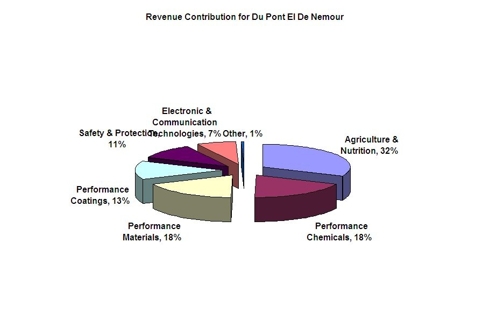

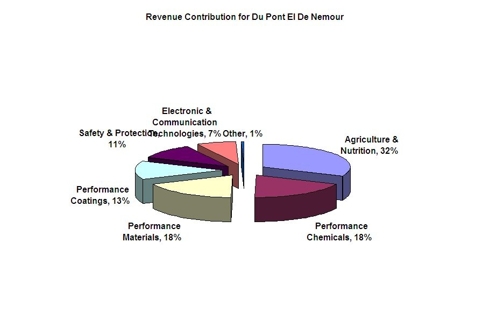

El DuPont De Nemours: DuPont beat the Q3 estimates for revenue and earnings and it lifted its outlook in Q3 2010 earnings report. A disappointment in automotive markets, performance coatings and performance polymers will be below the management’s guidance and analysts' expectations. The gross margins for most of the operating segments will also show contraction, in line with increase in feedstock cost. However, agricultural chemicals and the nutrition segment will help stave off the negative earnings effect from other operating segments and DuPont may post a small positive earnings surprise for the period ending December 31st 2010.

Saudi Basic Industries Corporation: SABIC reported Q4 2010 earnings last week. The earnings were above Reuter’s consensus of SAR5.3 billion, Bloomberg consensus of SAR6 billion and our in house estimates of SAR5.67 billion. However the investors may feel slightly disappointed, as expectations had been raised by YANSAB (51% owned by SABIC) and SAFCO (43% owned by SABIC) beating the markets expectations. The prices of most of the products sold by SABIC increased by +15% sequentially and the market was estimating an increase in sold volumes as CU rate should have increased. This was not reflected in the top line growth of only 5%. It implies that either sequential volumes and hence utilization rates were down or prices not reset to the benchmark prices in this quarter. We think that it is the price reset frequency which may have resulted in smaller than expected increase in the top line. Increase may have only come from the volumes increase because of increase in capacity utilization rates. Increase in price of Naphtha in the quarter (Q3/ Q42010) is also visible as we did not see a leverage impact at gross margin level – an increase in margins on the fixed cost side of business being absorbed by a decline in the margins on the variable cost side of the business. The net margins expanded by 100 bps (15%) because of YANSAB beating the estimated and higher associate income from SAFCO. We expect the utilization rate to be higher in Q1 2011 as inventories in Auto plastics are running thin. Product prices may be readjusted upwards in Q1 2011 as maximum lag is around 3-4 months. This may result in around 15% sequential increase in top line in 2011 which may result in a 27% increase in the bottom line, assuming a further 7% sequential increase in the cost of feed stock. However, leverage impact of the fixed cost side of business may dominate an assumed 7% increase in the variable side of the business resulting in a sequential improvement in the gross margins but a 100 bps yoy decline in the gross margins. We expect a good H1 2011 from the fertilizer business and overall earnings in H1 2011 can touch SAR14.74billion and SAR26-28 billion for the FY2011.

DOW Chemicals: Consensus expects the Dow Chemical Company to report the sales of $12.9 billion in Q4 2010 (23 percent yoy) (Bloomberg consensus). Top-line growth is expected to be driven by a 14% increase in volume and a 9% increase in price. Product prices have increased 15% sequentially, but the full impact of a benchmark prices increase may not be felt in the revenues because of contract reset frequency which on average lags the benchmark prices from three to six months. Based on historical price reset relationship, it may be fair to estimate only a 10% increase in the product prices and a sequential decline in the volumes – which may be more than consensus estimates. The volumes sold will be below consensus estimates in North America (17 percent), Latin America (9 percent) and 3% in Asia Pac which may cause a negative earnings surprise in Q4 2010.

The consensus estimates will be helped by strong pricing and volumes growth in agricultural & health segments but may be affected negatively by a drop in sold volumes in specialty chemicals and performance materials which constitutes 65% of total revenues.

Because of the drop in volumes sold in 52% of the revenue segment, Dow’s global rate may drop to around 82% in Q4 2010, 400 bps below last quarter’s 86%. Further, it is estimated that gross margins may decline by around 500 bps.

El DuPont De Nemours: DuPont beat the Q3 estimates for revenue and earnings and it lifted its outlook in Q3 2010 earnings report. A disappointment in automotive markets, performance coatings and performance polymers will be below the management’s guidance and analysts' expectations. The gross margins for most of the operating segments will also show contraction, in line with increase in feedstock cost. However, agricultural chemicals and the nutrition segment will help stave off the negative earnings effect from other operating segments and DuPont may post a small positive earnings surprise for the period ending December 31st 2010.

Complete Story »

The Avatars of Second Life Daniella Alonso Gina Gershon Ehrinn Cummings Sienna Miller

No comments:

Post a Comment